[size=0.9em]Policy responses to capital flows in emerging markets: Some new evidence

[size=0.9em]Atish R. Ghosh, Jonathan D. Ostry, Mahvash S. Qureshi 12 May 2017

[size=0.9em]There has been growing recognition that emerging markets may benefit from more proactive management of capital flows, and thus avoid crises when the flows recede. But do they do this in practice? By analysing policy responses in a sample of emerging markets, this column argues that central banks respond to capital inflows through various tools. Ironically, the most commonly prescribed instrument for coping with capital inflows – tighter fiscal policy – is the least-used tool in practice.

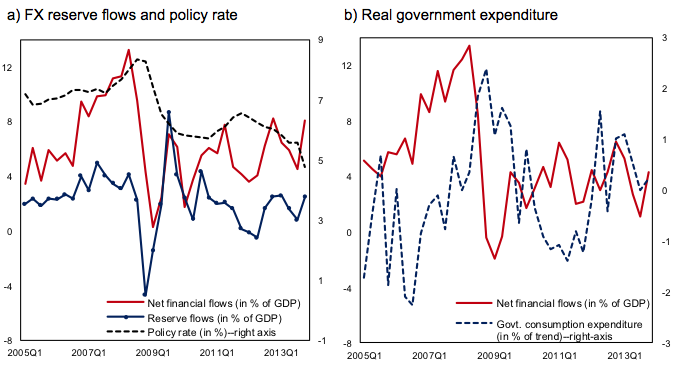

A look at the raw data suggests that capital flows to EMEs have been volatile over the sample period, but that EME central banks have reacted to this volatility. FX intervention – defined as a change in foreign reserve assets (excluding valuation changes) scaled by GDP – follows the ebbs and flows of capital, with a strong correspondence between reserve accumulation and net inflows (Figure 1a). For the policy interest rate the pattern is less clear, with the raw correlation between net capital flows to EMEs and the policy rate suggesting some counter-cyclicality (that is, the policy rate increased during periods of inflows and decreased during reversals), but this is not statistically significant. Fiscal policy – which, following existing studies, is proxied by real government consumption expenditure – shows no discernible relationship with net capital flows, with the unconditional correlation between the two series being close to zero and not statistically significant (Figure 1b).

Figure 1 Capital flows and macroeconomic policy response in EMEs, 2005Q1-2013Q4

Source: Authors’ calculations based on IMF’s IFS and WEO databases.

Notes: Statistics are averages for the corresponding samples. Real government expenditure is the cyclical component of (seasonally adjusted) real government spending in percent of trend real government spending.

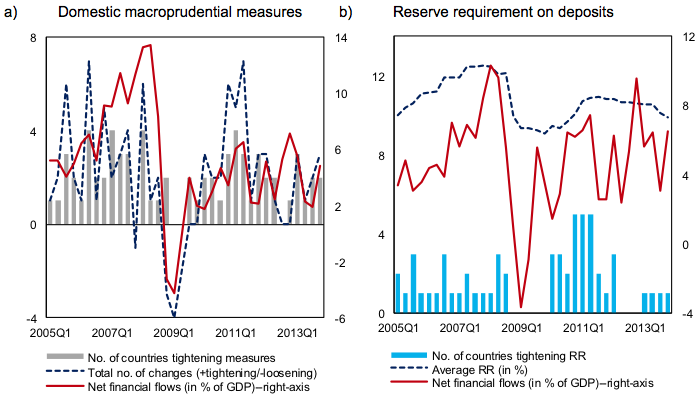

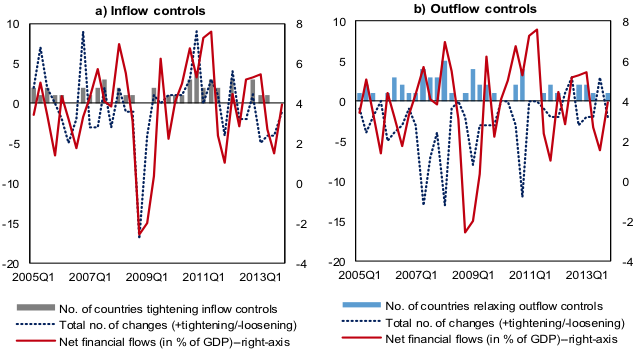

Turning to the less orthodox part of the policy toolkit – macroprudential measures and capital controls – and using indices that capture changes in these measures, a simple snapshot suggests that both the number of countries that tightened policies, as well as the total number of measures that were tightened (net of easing), was positively correlated with net inflows (Figures 2 and 3). Thus, EMEs tightened prudential policies and inflow controls as inflows surged, and relaxed them when flows receded.

Figure 2 Capital flows and macroprudential measures in EMEs, 2005Q1-2013Q4

Sources: Authors’ calculations based on data obtained from IMF’s IFS database, Federico et al. (2014), and Akinci and Olmstead-Rumsey (2015).

Notes: Net financial flows are the average for countries for which information on respective macroprudential policies/RR is available.

Figure 3 Capital flows and inflow controls in EMEs, 2005Q1-2013Q4

Sources: Authors’ calculations based on IMF’s IFS database, Ahmed et al. (2015), and IMF’s AREAER.

Notes: Net financial flows is the average for the countries in the sample for which information on changes in capital controls is available. Total no. of changes in panels [a] and are the cumulative number of measures tightened net of measures relaxed for the countries in the sample.

For outflow controls, the reverse is true. The number of countries relaxing restrictions, as well as the total number of measures relaxed (net of measures tightened), corresponded to capital inflows (Figure 3b). It is, however, important to note that the countries relaxing outflow restrictions were those with partially liberalised capital accounts (for example, India and South Africa). For EMEs with largely open capital accounts, the policy option of further relaxing outflow controls in the face of capital inflows may not have been available.

These initial observations are supported by formal regression analysis, which shows that:

While evidence suggests that EME policymakers responded to capital inflows through various tools, did the choice of policy instrument correspond with the nature of the risk posed by capital flows? In general, yes. The difference between the average real effective exchange rate (REER) appreciation in cases when FX intervention was used compared to when it was not used was significantly greater (about 5 percentage points). For monetary policy, the output gap mattered most, followed by the rate of domestic credit expansion, which were significantly larger when monetary policy was tightened.

Macroprudential measures were typically deployed in the face of rapid credit growth, while inflow controls were tightened when both credit growth and currency appreciation were a concern. On average, REER appreciation was 5 percentage points greater when both inflow controls and FX intervention were used compared to when FX intervention was used alone. Similarly, credit expansion was about 2 percentage points faster when both inflow controls and macroprudential measures were tightened than when the macroprudential measures were used alone. Moreover, inflow controls were generally used with at least one other instrument – suggesting that capital controls were deployed when countries were contending with multiple, and increased, risks that threatened financial and macroeconomic stability.

Figure 4 Policy Instruments and Risks, 2005Q1-2013Q4

Source: Authors’ estimates.

Note: Figures show the average year-on-year change in real domestic private credit growth and change in REER (in percent), output gap (in percent), and net capital flow/GDP (in percent) for the cases when policy instruments are used, and when they are not used. *, **, and *** indicate that the difference between the two group means is statistically significant at the 10, 5, and 1 percent levels, respectively.

We conclude that policymakers in EMEs have responded to capital flows by deploying a combination of instruments. Central banks used the policy interest rate to address inflation and overheating concerns, and intervened heavily in the face of capital inflows. Beyond these policies, EMEs tightened macroprudential measures, capital controls and currency-based measures that affect capital inflows, while countries with relatively closed capital accounts tended to relax restrictions on capital outflows. Moreover, there has been some correspondence between the tool deployed and the nature of the risk – thus, central banks intervened when the real exchange rate was appreciating, tightened monetary policy when the economy was overheating, and used macroprudential tools when financial-stability concerns dominated. Inflow controls were typically used when there were many, aggravated, risks. The orthodox policy prescription to tighten fiscal policy in the face of capital inflows was the least used instrument in practice, with no strong evidence that EMEs systematically tightened fiscal policy in response to large capital flows.

Disclaimer: The views expressed in this column are those of the authors, and should not be attributed to the IMF, its Executive Board, or its management.

ReferencesAhmed, S, S Curcuru, F Warnock, and A Zlate (2015), “The Two Components of International Capital Flows”, mimeo, University of Virginia.

Akinci, O, and J Olmstead-Rumsey (2015), “How Effective are Macroprudential Policies? An Empirical Investigation”, Federal Reserve Board International Finance Discussion Papers No. 1136.

Blanchard, O, J Ostry, A Ghosh, and M Chamon (2014), “Dealing with Capital Inflows”, keynote remarks made at the Central Bank of Chile’s conference on “The Role of Central Banks in Modern Times: Twenty-Five Years into the Central Bank of Chile’s Independence”, 24 October 2014, Santiago, Chile.

Eichengreen, B, and A Rose (2014), “Capital Controls in the 21st Century”, Journal of International Money and Finance, 48: 1-16.

Fernández, A, A Rebucci, and M Uribe (2015), “Are Capital Controls Countercyclical?” Journal of Monetary Economics, 76 (November), 1-14.

Ghosh, A, J Ostry, and M Qureshi (2017), “Managing the Tide : How Do Emerging Markets Respond to Capital Flows?” IMF Working Paper 17/69.

Ilzetzki, E, and C Végh (2008), “Procyclical Fiscal Policy in Developing Countries: Truth or Fiction?” NBER Working Papers 14191.

IMF (2012), The Liberalization and Management of Capital Flows: An Institutional View, Washington DC: International Monetary Fund.

Kaminsky, G, C Reinhart, and C Végh (2005), “When it Rains, it Pours: Procyclical Capital Flows and Macroeconomic Policies”, in NBER Macroeconomics Annual 2004, eds M. Gertler and K. Rogoff, 19: 11-82.

Ostry, J, A Ghosh, K Habermeier, M Chamon, M Qureshi, and D Reinhardt (2010), “Capital Inflows: The Role of Controls”, IMF Staff Position Note 10/04.

Ostry, J, A Ghosh, M Chamon, and M Qureshi (2012), “Tools for Managing Financial-Stability Risks from Capital Inflows”, Journal of International Economics, 88(2): 407-421.

Végh, C, and G Vuletin (2012), “Overcoming the Fear of Free Falling: Monetary Policy Graduation in Emerging Markets”, NBER Working Paper 18175.

扫码加好友,拉您进群

扫码加好友,拉您进群

收藏

收藏