But what exactly is The Elliott Wave Principle and how we can apply it to financial markets in real time?

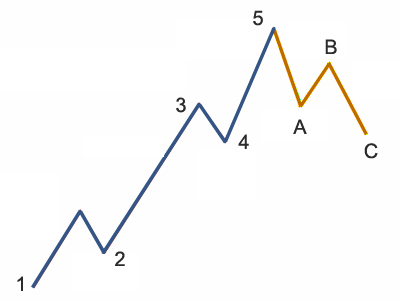

Elliott Wave 5-3 cycle

By studying 75 years of past market data, Elliott noticed that prices make five swings in the direction of the larger trend and only three swings against it. Those swings he called “waves”. If the trend is moving up, there are five waves in the upward direction and three downwards. If the trend is moving south, the Elliott Wave cycle is upside down – five down, three up.

Example of the 5-3 cycle is given below:

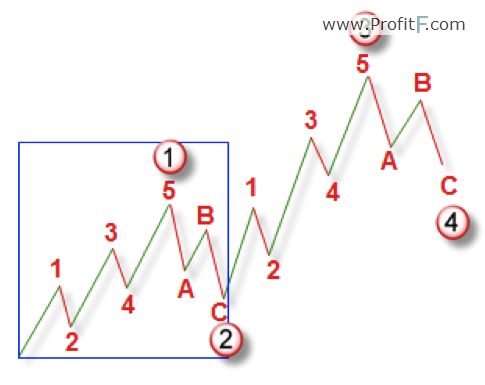

Furthermore, he found out that this 5-3 Elliott Wave cycle can be found on all degrees of trend. It stays the same, regardless of whether we are looking at a yearly or a five-minute chart.

Motive and corrective phases

The motive phase of the cycle is called an “impulse” and is labeled 1-2-3-4-5.

The corrective phase can be just a “correction”, labeled with a-b-c.

The basic principle of Elliott Wave Theory: Motive waves – 5 wave patterns in the direction of one larger degree trend, Corrective waves – 3 wave patterns in the opposite or counter direction to the trend of the next larger degree. (There are a few exceptions and variations, which will be discussed in this article)

Each wave of the five-wave sequence is constructed of smaller waves. Waves 1, 3 and 5 are impulses. waves 2 and 4 consist of only three waves.

扫码加好友,拉您进群

扫码加好友,拉您进群