1# huiaii

From wiki

---------------------------------------

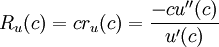

Relative risk aversionThe

Arrow-Pratt measure of relative risk-aversion (RRA) or

coefficient of relative risk aversion is defined as

.

Like for absolute risk aversion, the corresponding terms

constant relative risk aversion (CRRA) and

decreasing/increasing relative risk aversion(DRRA/IRRA) are used. This measure has the advantage that it is still avalid measure of risk aversion, even if it changes from risk-averse torisk-loving, i.e. is not strictly convex/concave over all

c.A constant RRA implies a decreasing ARA, but the reverse is not alwaystrue. However, as a specific example, the expected utility function

u(

c) = log(

c) does imply RRA = 1.

In

intertemporal choice problems, the

elasticity of intertemporal substitution is often unable to be disentangled from the coefficient of relative risk aversion. The

isoelastic utility function

exhibits constant relative risk aversion with

Ru(

c) = ρ and the elasticity of intertemporal substitution

. When ρ = 1 and one is subtracted in the numerator (facilitating the use of

l'Hôpital's rule), this simplifies to the case of

log utility, and the

income effect and

substitution effect on saving exactly offset.

扫码加好友,拉您进群

扫码加好友,拉您进群